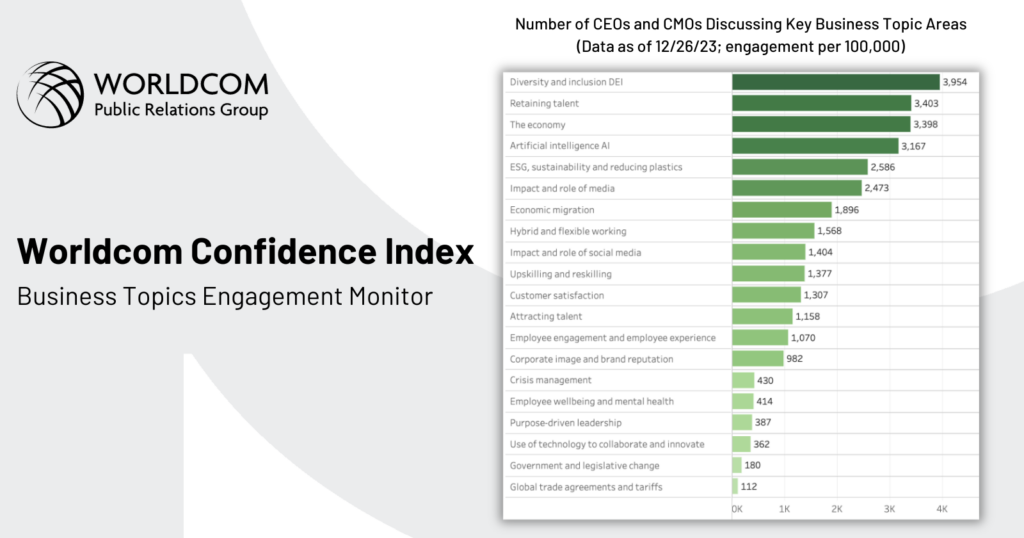

The AI-powered database used to track global business trends shows fascinating insights around DEI, AI, Hybrid Work, and More

By Daniel Ahern

The messages that C-Suite leaders echo through their social media platforms can serve as indicators of the most popular and timely trends in business. The Worldcom Confidence Index (WCI), created by the Worldcom Public Relations Group, a long-time partner of The Pollack Group, showcases AI-powered and up-to-date insights into global leaders’ confidence and sentiments around key business topics.

Tapping into the dialogue and conversations among C-Suite executives across the globe in numerous industries spanning the likes of finance, communication, and healthcare, here are some key takeaways from this past quarter:

DEI Tops the Leaderboard

The topics where C-Suite executives engaged most often in social media discourse are defined by uncertainty and skepticism. The most popular business topic area that C-Suite executives discussed on social media this past quarter was diversity, equity and inclusion (DEI). This can be most aptly explained by the backlash that we have witnessed this past year around this topic across political and business circles. This means that because the subject has been so heavily discussed and scrutinized, C-Suite leaders are talking about it.

According to DEI researcher and New York University professor Paulo Guadiano, “the wave of enthusiasm for [DEI] that began in 2020 started to wane in mid-2022, and has now turned into significant backlash. Corporate DEI budgets are being slashed, DEI consultancies are shutting down, and DEI initiatives are being attacked at many levels.”

Interestingly, despite this backlash around how corporate and educational diversity are measured and executed, DEI witnessed the third largest monthly change in confidence levels amongst all topics measured (+2.31%) *. The index shows that C-Suite executives maintain a positive outlook on DEI as a means to drive their businesses forward.

The AI Roller Coaster

Artificial intelligence (AI) comes in closely behind DEI, retaining talent, and the economy as one of the most heavily discussed subjects of Q4 2023.

AI-related engagement is down significantly from its peak in March 2023, shortly following the meteoric rise of ChatGPT. Additionally, C-Suite leaders’ confidence in artificial intelligence (-1.98%)* and the use of technology to collaborate and innovate (-4.10%)* has decreased significantly in the last month.

These trends can be explained by the minefield of AI platforms that have emerged in 2023 and particularly in the latter half of the year. Thought leadership around AI and its uses remains popular amongst C-Suite leaders, but uncertainty around its trajectory, combined with a lack of trust in these platforms to cater to their target audiences, is just as prevalent.

Widespread Declines in Engagement

According to the WCI’s Worldcom Trends Monitor, which measures the trends in engagement over time among C-Suite leaders on social media, overall engagement decreased at some level across every topic category (ex. the economy, customer satisfaction, attracting talent) and stakeholder category (ex. customers, influencers, shareholders) in Q4 2023.

C-Suite leaders engaged less frequently on social media in Q4 2023 compared to the rest of the year. While a similar downward trend emerged at this time last year, the Israel-Gaza War seems to have led C-Suite leaders to take a backseat to the global conflict that has dominated news media since the start of the quarter. Semafor editor Liz Hoffman recently deduced that “business leaders are keeping a low profile regarding the new Middle East conflict after a decade of public CEO statements on hot-button issues.”

Honorable Mentions

In addition to these widespread trends, we are paying close attention to the following WCI data points:

- ESG, sustainability, and reducing plastics, rounds out the Top 5 of Key Business Topic Areas that C-Suite leaders are discussing, a realm where genuine and transparent communication is essential. This Top 5 list underwent no changes since the start of Q4 2023.

- Hybrid and flexible working witnessed the highest increase in C-Suite executive confidence (+3.05%)* over the course of the past month.

- Government and legislative change witnessed the highest decrease in C-Suite executive confidence (-5.23%) * over the course of the past month.

A Look Ahead

We expect the economy and artificial intelligence to rise in the highest ranks of topic engagement as hot-button issues approaching 2024 election season, competing with DEI for the top spot. Engagement in the topic of hybrid and flexible working, is likely to rise as hybrid schedules increase and popularity and conflicting perspectives about returning to the office, circulate throughout the media.

More broadly, we expect C-Suite leaders and marketers to increase social media engagement in the upcoming quarter, despite ongoing geopolitical tensions and a shifting economic landscape. The focus will likely be on reinforcing crisis management strategies and ensuring that communication aligns with stakeholder values.

*data as of 12/26/23