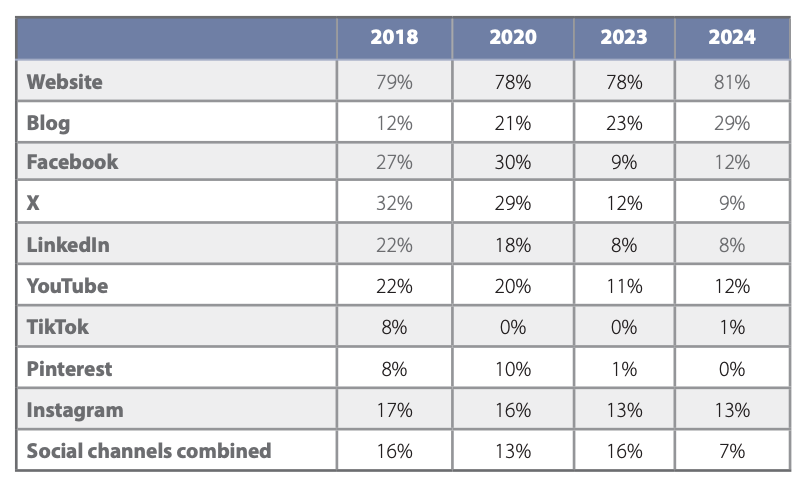

The Digital Health Monitor for the Pharma Sector, an annual report by the Worldcom Public Relations Group collects and analyzes data from global pharmaceutical companies based on their size, global reputation, and geographic presence. This report ranks each of these companies based on their presence and engagement across various platforms, including apps, blogs, corporate and local company websites, Instagram, Facebook, LinkedIn, Pinterest, Snapchat, TikTok, X, and YouTube. In addition, the report examines the use of these channels by country.

The annual bellwether report is crucial because it uncovers significant gaps: many leading pharmaceutical companies have not been effectively leveraging localized content, missing huge opportunities to educate their target audiences and safeguard their brands. In an era where misinformation is rampant, it is more essential than ever for organizations to ensure that consumers perceive them accurately, especially in an industry as critical and valuable as pharmaceuticals.

Social Media: The New Information Hub

The first key takeaway is the evolving role of social media and the internet, which are increasingly used for information rather than simply entertainment. Notable increases have been seen in users seeking news, inspiration, product research, health-related information, and educational content. Social media is no longer just a networking tool—it has become a primary resource for research and discovery.

Yet, the pharmaceutical industry has largely failed to capitalize on this shift. For instance, TikTok, the most popular platform globally, leads all social media in time spent per month, with users spending an average of 34 hours on the app. Despite this, pharmaceutical companies average just 1% use of TikTok, and their combined social media presence is a mere 7%.

This underutilization represents a significant missed opportunity. Pharmaceutical companies are not just failing to reach key audiences; they are completely neglecting the most influential stage for consumer engagement. To deliver critical information effectively, these companies must adapt to the rapidly changing digital landscape.

Interconnecting Priority Topics

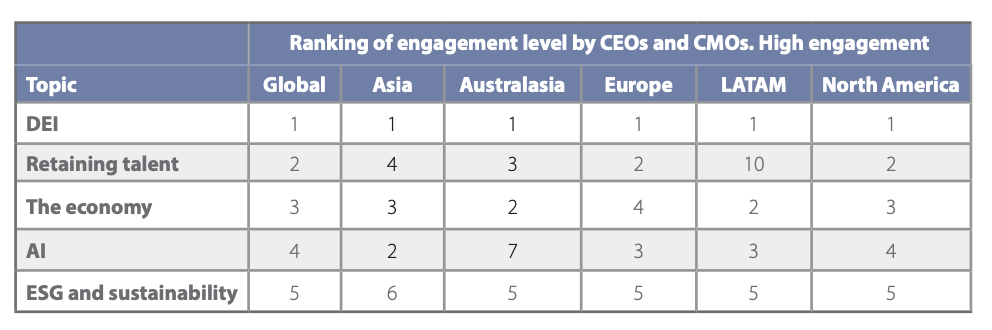

The report also highlights the interconnection between priority topics. According to CEO and CMO engagement rankings, the top five topics globally are DEI, retaining talent, the economy, AI, and ESG and sustainability. However, attracting talent ranks only 13th despite talent retention being the 2nd most discussed topic. As new generations enter the workforce, pharmaceutical companies will need to balance their communications strategies to avoid future talent shortages.

These rankings underscore the importance of targeted communication. Social channels can play a vital role in both retaining and attracting employees, but companies will need to tailor their messages to specific audiences. For example, two-thirds of Gen-Z prioritize working for employers that align with their values, emphasizing the need for companies to clearly communicate their ethical pillars.

Moving forward, pharmaceutical companies must carefully consider how to use social channels to communicate their leadership and stance on critical issues. While sharing product information is important, addressing social, political, and economic issues is also critical. Developing a coherent communications strategy will be paramount for enhancing brand awareness and resonating with consumer values.

Factors Shaping the Future of the Pharmaceutical Industry

The way pharmaceutical companies communicate is not the only thing changing; the industry itself is evolving. While opinions vary, there is a consensus on several factors likely to shape the future:

- National Health System Reforms: Stricter access and pricing regulations are being introduced as national health systems reform to limit healthcare spending, which could significantly impact the pharmaceutical industry’s cash flow.

- Changing Patient Expectations: Many consumers harbor negative perceptions of the healthcare system, leading to a reluctance to engage with healthcare services due to cost and inconvenience. This presents a challenge for pharmaceutical companies to overcome.

- Misinformation from AI: As AI advances, so too does the risk of misinformation. Pharmaceutical companies must be prepared to combat these dangers while leveraging AI’s potential for innovation.

- Society and Social Media: The world is constantly changing. While social media is popular now, its future impact is unpredictable. Staying on top of trends is critical for pharmaceutical companies to maintain their relevance and deliver the innovations expected from them.

This year’s Digital Health Monitor for the Pharma Sector offers valuable insights. From the rise of social media as an information source to the critical issues shaping business decisions, the report provides pharmaceutical companies with powerful tools to optimize their digital communication strategies. Moreover, it equips them to enhance the products and services they offer.

As we look to the future, let’s remain cautiously optimistic. Despite the challenges, the industry has shown steady improvement in recent years. While there is still much work to be done, the trajectory is promising. The pharmaceutical industry continues to make significant impacts, and we hope that one day, their digital presence will fully reflect the innovative thinking that consumers seek in their products.

If you would like to learn more about our Worldcom Public Relations Group partnership, visit here.